Get a 30% tax credit when you install solar panels!

Start your solar installation today!

The federal solar tax credit, formally known as the solar Investment Tax Credit (ITC), is the best solar incentive available in the United States. Thanks to the solar panel federal tax credit, homeowners and businesses can significantly reduce the cost of a solar energy system installation, making it easier to go solar in Arizona.

Many of the homeowners we meet throughout the Phoenix and Tuscon areas have heard about the federal solar tax credit but have a lot of questions about how it works and whether they’re eligible to receive it. Energy Solution Providers is here to answer your questions and help you maximize your solar savings!

What Is the Federal Solar Tax Credit?

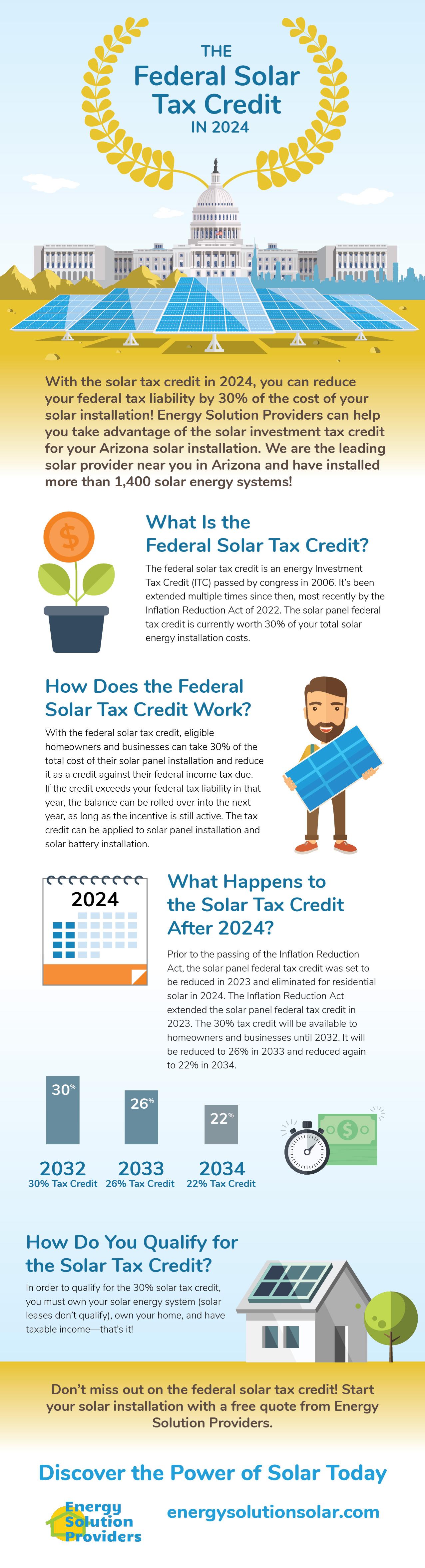

The federal solar tax credit is a government tax incentive program that can greatly reduce the upfront cost of your residential or commercial solar installation. The solar tax credit allows homeowners and businesses to reduce their federal tax liability by 30% of their total solar installation costs. It applies to solar panels and solar battery storage, and batteries can qualify even if they are not connected to or charged by solar panels.

How Does the Inflation Reduction Act Impact the Federal Solar Tax Credit in 2024

The Inflation Reduction Act of 2022 was signed into law in August, and there are a lot of questions surrounding the Inflation Reduction act and solar panels.

Thanks to the Inflation Reduction Act, the solar tax credit has been increased to 30% and extended for 10 years. The 30% federal solar tax credit will be in effect until 2033, and there is no cap on the incentive, which means you are entitled to the full 30% tax reduction whether you spend $5,000 or $500,000 on your solar installation.

The Inflation Reduction Act also makes standalone battery storage eligible for the solar tax credit for the first time.

How to Qualify for the Federal Solar Tax Credit

The Federal solar tax credit allows homeowners to reduce 30% of the total costs related to their solar installation from what they owe on their federal taxes due.

In order to be eligible for the solar tax credit, you must:

Own the property your solar system is installed on

Own your solar PV system (leased solar panels do not qualify, but financed systems do)

Have taxable income

If your solar tax credit exceeds your federal tax liability, the Federal ITC does allow for one year of carryover for the remaining, unused deduction amount.

Once we wrap up the installation of your carefully designed solar PV system, our solar experts will help you to add up your qualifying installation costs, so you can reduce the maximum amount on your taxes come April.

Making Solar Panel Installation Affordable in Arizona

Energy Solution Providers is the leading solar provider near you in Arizona, and we’re committed to making solar energy affordable for local homeowners and businesses. We can help you qualify for the 30% federal solar tax credit, navigate the SRP solar rate changes, qualify for utility rebate programs, finance your solar installation, and identify any other opportunities to reduce the cost of your installation.

The lower your solar installation costs, the quicker your payback period. And the sooner you can offset the cost of installation, the sooner you can profit from the energy savings your solar PV system provides! We design systems that will last for decades, so you can rest easy knowing that your investment in solar will provide a financial return and can even increase the value of your home.